A guide to purchasing a non-standard home

Contents |

[edit] Introduction

A non-standard home refers to a property that has not been built using the traditional materials that roperty would have been built with. Standard houses are comprised of brick or stone walls with a slate or tile roof, whereas a non-standard construction refers to any property that does not conform to these traditional expectations.

You tend to find non-standard homes in areas where the construction materials are readily available. When buying a non-standard home, you need to fully understand the risks involved and must be aware of the differences when applying for a mortgage and insurance.

[edit] The lifespan of non-standard homes

One of the main reasons people look upon non-standard homes with scepticism is due to the issues that present themselves as the property starts to age. Some non-standard properties feature concrete walls, and as time goes on, these walls can crack and crumble as the steel rods holding the property together begin to corrode.

Although any property can deteriorate over time and there is no timeframe as to when this could happen, non-standard homes are sometimes more susceptible to damage and material breakdown. This makes it more difficult for lenders to judge the risk of the property, which in turn makes it more difficult to secure modern construction home insurance, and this inevitably makes it more difficult to apply for a mortgage.

[edit] Demand for non-standard homes

There is usually a limited demand for non-standard homes due to the difficulties that surround ownership. Not only is it difficult to obtain insurance and a mortgage, it may also be difficult to maintain this type of property and this can discourage buyers as they fear renovation costs could be high. It can be difficult to tell whether a non-standard property has been looked after, and instead of falling victim to steep restoration fees, buyers opt for more traditional properties.

[edit] Applying for a non-standard home mortgage

Just like with everything in life, people may be sceptical about things they don’t understand, and this is the same with mortgage lenders.

Lenders are hesitant when it comes to offering a mortgage for a non-standard home, and this is because the demand for such property may be limited. Therefore mortgage providers believe that should you default on your payments, it will be more difficult to recoup their losses in the form of a resale.

Non-standard homes may also require more maintenance and upkeep, and again lenders worry that they could financially lose out if the value of a property decreases.

[edit] Non-standard buildings insurance

It is important to have the correct insurance policies in place including non-standard buildings insurance and specialist modern materials home insurance.

Similar to mortgage providers, insurers can lack the specialist skills and knowledge to be able to properly asses the risks of a non-standard home, and in turn they may increase their premium, or in the worst case scenario, refuse to insure the property at all.

Whether you’re buying a timber framed house, prefabricated concrete home, or a log style cabin, it is important to know the risks associated with buying non-standard property and be aware that you may have to sell your house at a lower price than you brought it for in order to generate buyer interest in the future.

--Indlu 14:18, 29 Nov 2018 (BST)

[edit] Related articles on Designing Buildings Wiki

- Custom-build homes.

- Kit house.

- Open source architectural plans for modular buildings.

- Right to build.

- Self-build and Custom Housebuilding Bill 2014-15.

- Self build and custom housebuilding registers.

- Self-build home

- Self-build home project plan.

- Self-build homes negotiating discounts.

- Self-build initiative.

- Types of building.

- VAT refunds on self-build homes.

- Walters Way and Segal Close.

Featured articles and news

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

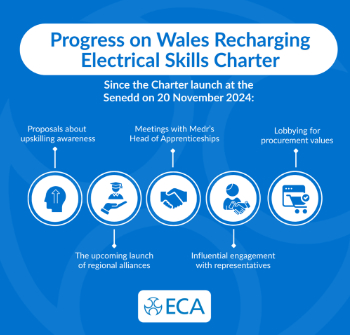

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.